Navigating Medicare enrollment is not just about signing up for health insurance — it’s about timing. Missing key deadlines can result in permanent financial penalties, gaps in coverage, or limited access to plans. As someone who has worked in Medicare policy for over 20 years, I’ve seen how costly even small delays can be for unsuspecting beneficiaries.

This guide breaks down everything you need to know about enrollment periods, penalties, and how to avoid common (and expensive) mistakes.

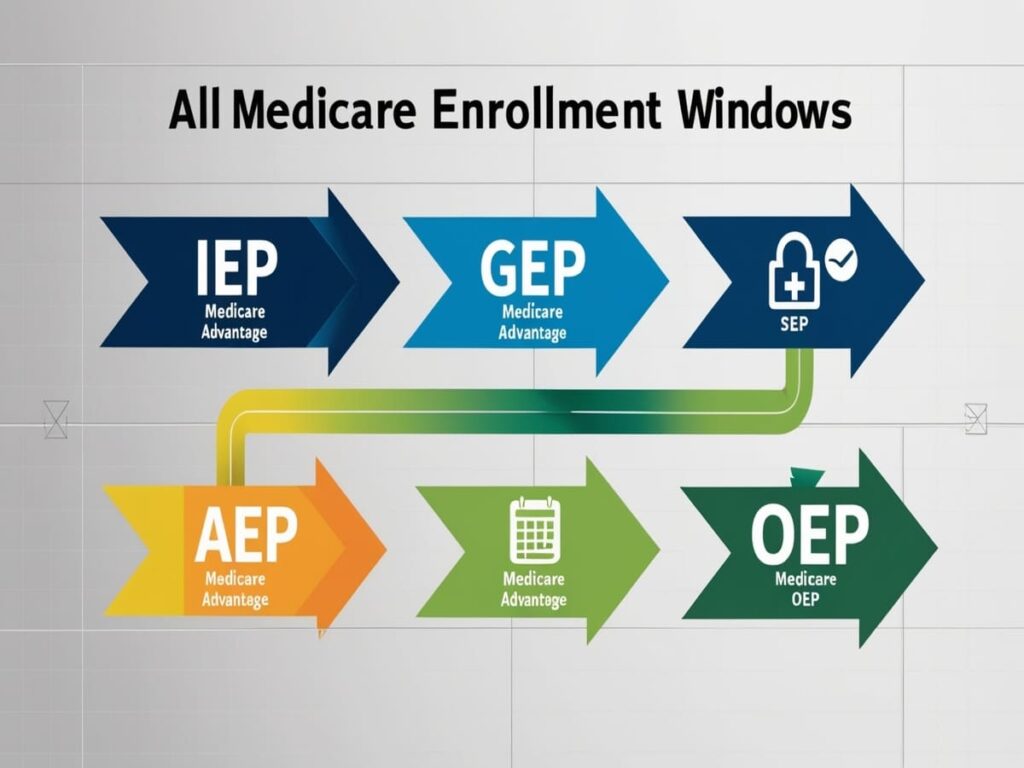

1. Initial Enrollment Period (IEP): Your First Medicare Window

The Initial Enrollment Period (IEP) is the first chance most people have to enroll in Medicare. It begins three months before the month you turn 65, includes your birth month, and extends three months after — for a total of seven months.

What You Can Do:

- Enroll in Medicare Part A (hospital insurance)

- Enroll in Medicare Part B (medical insurance)

- Choose a Medicare Advantage (Part C) or Part D (drug plan)

Why It Matters:

If you don’t sign up for Part B during this window (and don’t have other credible coverage, such as employer-sponsored insurance), you may face a late enrollment penalty (detailed below).

2. General Enrollment Period (GEP): For Those Who Missed the IEP

If you miss your IEP and don’t qualify for a Special Enrollment Period, you must wait for the General Enrollment Period, which runs from January 1 to March 31 each year.

- Your coverage will begin on the first day of the month after you enroll.

- You may face a penalty (see below) for each year you delayed enrollment in Part B without creditable coverage.

3. Special Enrollment Period (SEP): For Those with Employer Coverage

If you’re still working past 65 or are covered under a spouse’s employer plan, you may qualify for a Special Enrollment Period (SEP).

Key Facts:

- The SEP lasts for 8 months after your employment ends or your group health coverage ends — whichever comes first.

- You can enroll in Part B and Part A (if not already enrolled) without penalty during this time.

This SEP does not apply to Medicare Advantage or Part D plans — those have separate SEP rules depending on your situation.

4. Annual Enrollment Period (AEP): October 15 – December 7

This is when current Medicare beneficiaries can:

- Switch between Original Medicare and Medicare Advantage

- Change from one MA plan to another

- Join, drop, or switch a Part D plan

Changes take effect January 1 of the following year.

5. Medicare Advantage Open Enrollment Period: January 1 – March 31

If you’re already enrolled in a Medicare Advantage (MA) plan, this period allows you to:

- Switch to another MA plan

- Drop MA and return to Original Medicare (+ optional Part D)

You cannot switch from Original Medicare to MA during this time.

6. Late Enrollment Penalties: A Cost You Carry for Life

Part B Penalty:

If you delay Part B and don’t have credible coverage, you pay:

10% extra for each full 12-month period you were eligible but didn’t enroll.

- This penalty lasts for as long as you have Part B.

- Example: If you delay enrollment by 2 years, you’ll pay 20% more on your monthly premium for life.

In 2025, the standard Medicare Part B premium is $185.00 per month. A 20% late enrollment penalty would add $37.00, bringing your total to $222.00 per month — every month for life.

Part D Penalty:

If you go 63 days or more without creditable drug coverage after your IEP, you’ll pay:

1% of the national base beneficiary premium for each month you went uncovered.

- The 2025 base premium is projected at $35.00.

- A 12-month delay = 12% penalty, or $4.20 extra per month.

- This penalty is added to your premium for life.

7. Medigap Enrollment and Underwriting Rules

If you want to purchase a Medigap policy to supplement Original Medicare:

- You have a 6-month open enrollment window that begins when you first enroll in Part B and are 65 or older.

- After that, insurers in most states can deny coverage or charge more based on your health.

Some states (like New York and Connecticut) have guaranteed issue rights year-round, but most do not. Missing this window can lock you out of supplemental protection.

8. How to Avoid Mistakes

✅ Know your dates: Mark your IEP on your calendar 6 months before turning 65.

✅ Don’t assume employer coverage is enough — get confirmation it’s “creditable.”

✅ If in doubt, call SHIP (State Health Insurance Assistance Program) for free, unbiased advice.

✅ Check www.medicare.gov regularly for updated enrollment deadlines and premium info.

Conclusion: Missing a Deadline Can Cost You — For Life

Medicare isn’t just another insurance program — it’s a time-sensitive decision with lifelong financial consequences. The government penalizes procrastination, and even well-meaning delays can mean hundreds or thousands in extra costs every year.

Make sure you:

- Enroll at the right time

- Understand what qualifies as creditable coverage

- Don’t rely on assumptions or ads use verified sources

The best way to avoid Medicare mistakes is to plan early, ask questions, and use all the resources available to you.

Need help evaluating your Medicare options or ensuring you’re on track? Learn more about Medicare plans, enrollment help, and trusted Medigap coverage options endorsed by AARP here.